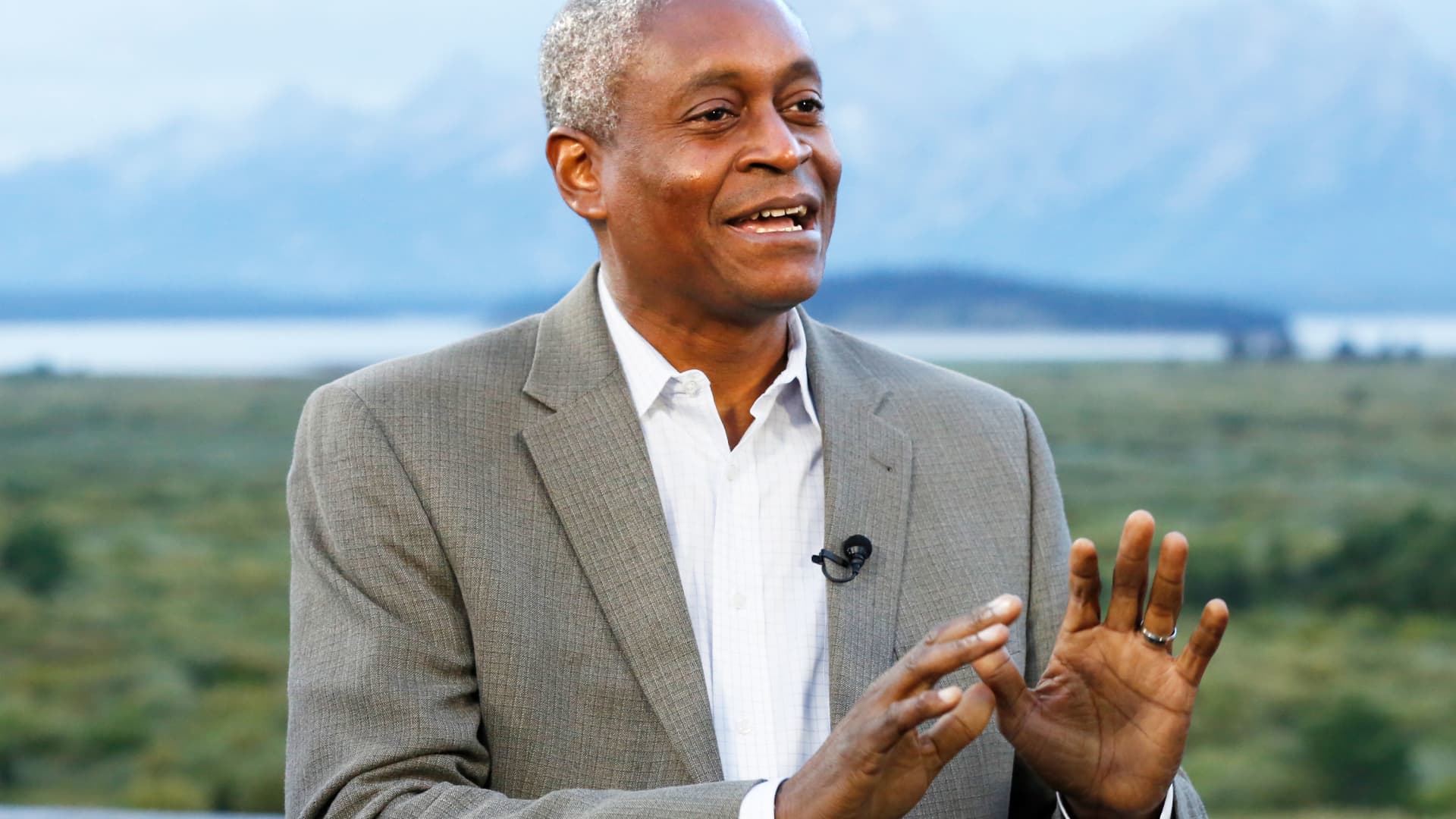

Atlanta Federal Reserve President Raphael Bostic mentioned Tuesday he envisions the central financial institution approving yet another rate of interest improve earlier than pausing to see how coverage tightening is impacting the financial system.

“Yet another transfer must be sufficient for us to then take a step again and see how our coverage is flowing via the financial system, to grasp the extent to which inflation is returning again to our goal,” Bostic mentioned throughout a stay interview on CNBC’s “Squawk on the Road.”

That 0.25 proportion level improve probably will come on the rate-setting Federal Open Market Committee’s Could 2-3 assembly.

If a majority of the committee has the identical view as Bostic, who’s a nonvoting member this yr, that may take the federal funds price to a goal vary of 5%-5.25%, the best since August 2007.

From there, Bostic mentioned he thinks the FOMC can watch because the lags that include financial coverage work their manner via inflation, employment and the broader U.S. financial image.

“If the information are available as I anticipate, we can maintain there for fairly a while,” he mentioned. “As soon as we get to that time, I haven’t got us actually doing something however monitoring the financial system for the remainder of this yr and into 2024.”

Markets, nonetheless, disagree that the Fed can be in a maintain posture.

Present pricing signifies an 87% likelihood of a quarter-point hike subsequent month, a pause for just a few months, then a half proportion level minimize by the tip of 2023 because the financial system slows, based on CME Group estimates. Bostic mentioned inflation remains to be operating too sturdy to think about cuts.

“A part of that is actually about … inflation’s returning again to our 2% goal. I do not assume that is going to occur as shortly as among the markets do. And it appears that evidently the query is who’s proper on this?” he mentioned. “I do not see it coming down under perhaps 3½. And 3½ remains to be nicely above our 2% goal.”

He additionally famous that he doesn’t foresee the financial system tilting into recession, regardless that Fed economists warned on the March FOMC assembly {that a} delicate contraction is probably going later within the yr.

Bostic added that tight financial coverage is more likely to persist regardless of the latest troubles within the banking trade which are forecast to set off the recession.

He described the state of banking in his district as “secure,” although he famous that “you by no means know when the subsequent shoe would possibly drop,” including that the Fed will stay vigilant “to guarantee that we’re prepared.”