The Environmental Safety Company mentioned that it was canceling $20 billion in grants for local weather and clear power applications which have been frozen for weeks, a transfer that was labeled unlawful by nonprofit teams that have been speculated to obtain the funds.

The cash has been caught in an escalating controversy involving the E.P.A., the Justice Division, the Federal Bureau of Investigation and Citibank, the place the funds are being held and at the moment are frozen, prompting lawsuits from three nonprofit teams.

The grants have been issued to a complete of eight nonprofit organizations by means of the Greenhouse Fuel Discount Fund, which acquired $27 billion in funding from Congress by means of the 2022 Inflation Discount Act.

However since taking workplace, Lee Zeldin, the E.P.A.’s administrator, has tried to claw again the cash, saying they have been a part of a “scheme” and citing as proof a hidden-camera video from Venture Veritas, a conservative group recognized for utilizing covert recordings to embarrass its political opponents.

The E.P.A. can cancel the grant contracts if it might doc examples of waste, fraud, and abuse by the grantees. However that hasn’t occurred at this level.

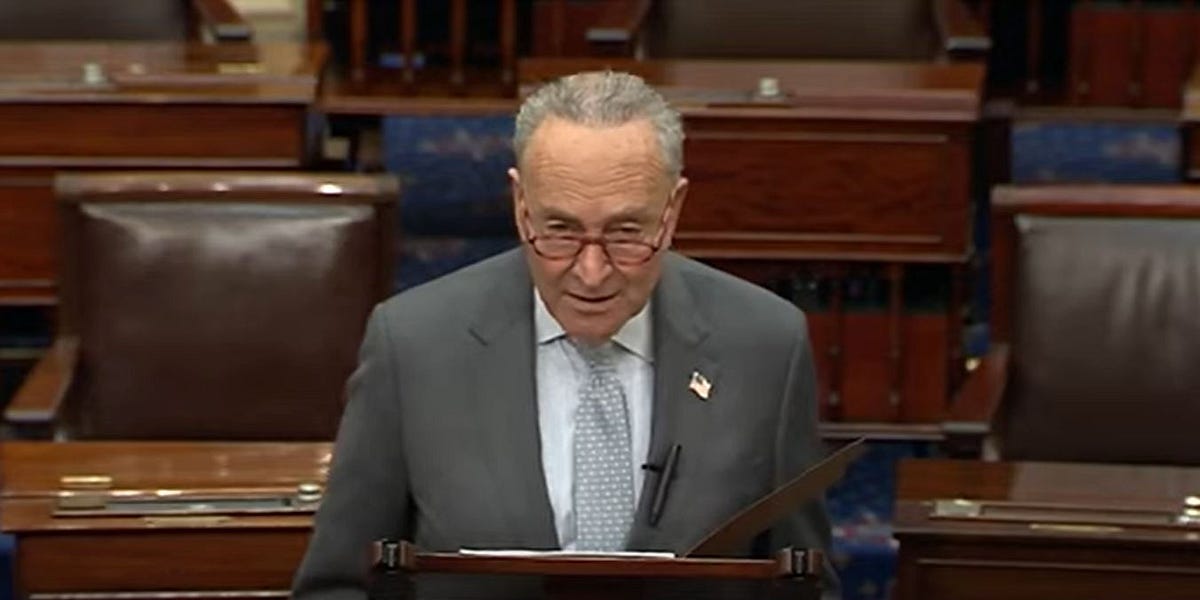

Yesterday, Democrats on the Home Vitality and Commerce Committee launched an investigation into the E.P.A,’s freezing of the funds and what they mentioned have been Mr. Zeldin’s “false and deceptive statements.”

Two of the nonprofit grant recipients, Local weather United and the Coalition for Inexperienced Capital, mentioned they are going to battle the cancellation. A courtroom listening to on a associated case is scheduled for Wednesday.

Here’s what we all know in regards to the $20 billion in funding and the way it grew to become a goal of the E.P.A.

How the controversy began

In February, Mr. Zeldin introduced that he had discovered billions of {dollars} of “gold bars” of grant funding at Citibank, calling the Greenhouse Fuel Discount Fund (or “inexperienced financial institution”) grant program a “scheme” and a “rush job with no oversight.”

Mr. Zeldin has embraced the Trump administration’s emphasis on spending cuts, touting his work with the Division of Authorities Effectivity. He has canceled scores of different E.P.A. contracts, totaling what the company mentioned is round $2 billion throughout greater than 400 initiatives.

The “gold bars” remark was a reference to a video launched in December by Venture Veritas wherein Brent Efron, then an E.P.A. worker, likened his company’s efforts to spend federal funds on local weather applications earlier than leaving workplace to throwing “gold bars” off the Titanic.

Mr. Efron’s lawyer has denied his consumer was referring to the Greenhouse Fuel Discount Fund.

After Mr. Zeldin’s assertion, Ed Martin, the interim U.S. legal professional for Washington D.C., requested Denise Cheung, a prime federal prosecutor, to freeze the $20 billion held by Citibank. However she abruptly resigned after figuring out there was not sufficient proof to order the funds frozen. The F.B.I. and the Justice Division continued their investigations.

Final week, Mr. Zeldin additionally referred the matter to his company’s appearing inspector basic for a 3rd, concurrent investigation.

The nonprofit grant recipients started executing their authorized protection this previous weekend, when Local weather United sued E.P.A. and Citibank, claiming they have been illegally withholding the cash. Two different recipients filed fits in opposition to Citibank within the following days.

A listening to on Local weather United’s request for a short lived restraining order to launch the funds was scheduled for Wednesday in the US District Court docket for the District of Columbia.

What the nonprofits are saying

The cancellations shocked Local weather United, a nonprofit group that was awarded practically $7 billion, mentioned Beth Bafford, the group’s chief government officer. She mentioned she acquired an official termination letter a half-hour earlier than the company issued a public assertion.

The nonprofits have been unable to entry the funds of their Citibank accounts since mid-February. The funds have been held there underneath an settlement between the E.P.A. and the financial institution.

With out the promised funds, some teams mentioned they’re struggling to pay workers.

In a termination letter considered by The New York Occasions, the E.P.A. mentioned it had recognized “materials deficiencies” in this system, together with the absence of sufficient oversight and improper or speculative allocation of funds. It didn’t present any proof.

The Coalition for Inexperienced Capital, one of many largest recipients, referred to as the E.P.A.’s choice “unauthorized and illegal,” and mentioned it was contemplating authorized choices.

What we all know in regards to the $20 billion program

The $20 billion program was designed to supply low-cost loans to companies and builders for local weather initiatives, which embrace issues like putting in photo voltaic panels and retrofitting houses to make them extra power environment friendly.

The E.P.A. distributed the cash to eight nonprofits, which deliberate to distribute the cash as loans in addition to grants to native “inexperienced banks’” or credit score unions, which might in flip make their very own loans.

The concept was that the dedication of federal {dollars} would entice non-public investments to inexperienced initiatives.

Mr. Zeldin has made a lot of the truth that $20 billion in grant cash was held at Citibank, portraying the E.P.A.’s choice to make use of an outdoor monetary establishment as an middleman as an try and subvert oversight.

Grant recipients and former E.P.A. officers have disputed this characterization, and mentioned that the company has full visibility into transactions by means of the Citibank accounts for the nonprofit organizations and their sub-recipients

It’s not clear how a lot of the $20 billion was spent earlier than the freeze was put in place.

A spokeswoman for the E.P.A. mentioned it couldn’t reply how a lot of the cash has been loaned out by the nonprofits as a result of the funds have been spent underneath the Biden administration.

Citibank didn’t reply to request for remark.