We have all heard of males shopping for midlife disaster automobiles to really feel extra alive (or make up for shortcomings). However what about shopping for a midlife disaster home? Have you ever ever considered such an attention-grabbing phenomenon?

For instance you are dwelling in a wonderfully fantastic home that matches all of your wants. It has the greatest structure with the appropriate variety of bedrooms, proper variety of loos, an workplace, and a few decks overlooking the ocean. What extra may you ask for proper?

It seems, while you’re experiencing a midlife disaster, being content material with what you will have can typically get thrown out the window!

A Midlife Disaster Can Relate To Many Issues

Now that I am firmly middle-aged, I am attempting to concentrate on something I am doing that is out of whack. If we’re doing one thing as a result of a midlife disaster, we could also be attempting to compensate for our lack of shallowness or lack of satisfaction in some a part of our life.

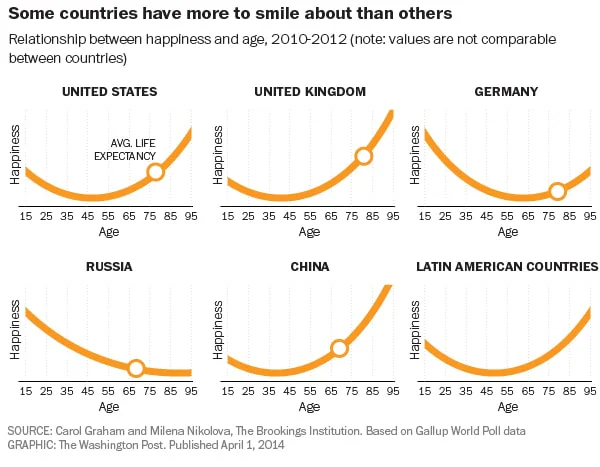

Since 40, I have been constructing a mid-life disaster fund to probably take care of a dip in satisfaction sooner or later. Loads of surveys have confirmed life satisfaction troughs in a single’s 40s and early 50s, then recovers.

Listed here are some issues I’ve thought of not too long ago.

Potential midlife disaster examples:

- Am I consuming much less and exercising extra as a result of I wish to look horny for the women on the pickleball courtroom? Or am I doing so as a result of I wish to really feel higher and enhance my possibilities of dwelling an extended and more healthy life? The explanations could also be each. Nevertheless, if I am not going by way of a midlife disaster, the predominant cause must be the latter, particularly for my household.

- Am I recording extra podcasts to realize extra recognition as a result of I do not really feel like I’ve executed sufficient in my life? Or am I recording extra just because I get pleasure from a brand new problem and wish to develop an archive of recordings for my children? If the will for recognition is greater than 50% of the rationale, that is totally different from being the no person I am used to.

- Am I shopping for a brand new home that I needn’t look extra essential to different mother and father and mates given I haven’t got a job or a lot standing? Or am I shopping for a brand new home as a result of I believe it’s going to present for a greater life-style for my household? If the principle cause is the previous, then I could also be going by way of a midlife disaster.

Why We Want A Midlife Disaster Home

Some persons are creatures of behavior. Irrespective of how a lot cash they’ve, they are not prepared to maneuver.

Maybe essentially the most well-known instance is Warren Buffett nonetheless dwelling in the home he purchased in 1958 in Omaha, Nebraska. Again then, he paid $31,500, the equal of round $350,000 in right now’s {dollars} after inflation.

Positive, the home is 6,570 sq. toes, thought-about mansion-sized by some. However it prices nothing in contrast along with his $100+ billion web value.

Listed here are some explanation why a few of us purchase unneeded homes in our 40s and 50s.

1) A elaborate automobile simply will not do it anymore

If now we have the power to purchase a midlife disaster home, then we most definitely can afford to purchase a midlife disaster automobile already. We have both already bought our dream automobile or we simply aren’t that into automobiles.

The irony is, shopping for a midlife disaster automobile may finally prevent much more cash. As a result of when you can fulfill the outlet you’re feeling inside with a flowery new automobile, you will not have to purchase an unneeded nicer residence.

My getting old automobile

I purchased my Vary Rover Sport in December 2016, primarily in preparation for the beginning of our son in April 2017. We had been driving a Honda Match on a three-year lease that was coming due and we needed a bigger, safer automobile for our household. Nevertheless, if I used to be going to purchase a brand new used automobile, I needed one which I liked.

The Vary Rover has been one among my favourite automobiles since center faculty. Since beginning work, I’ve bought nearly each automobile I’ve ever dreamt of proudly owning since I used to be a child: MB G500, BMW 635CSi, BMW M3, LR Discovery II. It has been a enjoyable journey!

Given it has been seven years since I purchased my present Vary Rover, its novelty has worn off. Therefore, it is doing nothing to offset the itch to purchase a midlife disaster home. However I nonetheless love Moose II all the identical.

2) Maintaining with the Joneses

If in case you have a day job, you will witness your coworkers getting paid and promoted. As they get promoted, they’re going to purchase nicer properties and different luxurious issues. You may naturally wish to preserve tempo with their success, given you could really feel much less profitable when you do not.

Should you aren’t already surrounded by extremely motivated individuals at work, you could be as a mum or dad throughout faculty features and playdates. In consequence, additionally, you will find yourself evaluating your issues to the issues owned by different mother and father.

Earlier than assembly anyone, you could possibly have been completely proud of your home. Nevertheless, after assembly different individuals of your related age and standing with nicer properties, you may start to query every thing!

You may marvel how on earth can these individuals can afford their home, their automobile, and the opposite good issues? The reply is usually lots of debt, which as a FIRE individual, you employ loads lower than common. Then you definitely may begin pondering why somebody much less deserving have nicer issues than you.

Mixing again in with working society

One of many good issues about leaving work in 2012 is not being surrounded by type-A, ultra-competitive people who continually purchase good issues. Not listening to about their purchases helped cease me from craving nicer issues.

Nevertheless, as soon as my son began faculty, I used to be injected again into society. I began attending to know different mother and father who went on cool holidays, drove costly automobiles, and purchased new homes. As a author, it was fascinating to look at the “peacocking” that typically went on at playdates.

After a mum or dad hosted a celebration at his modest home at some point, I requested myself whether or not I used to be proud sufficient to host poker evening at my home sooner or later. As well as, I questioned whether or not I can buy a nicer home to impress different mother and father! Earlier than plugging again into the Matrix, I by no means thought of these items.

3) The conclusion that you could be die with an excessive amount of cash

Probably the greatest methods to decumulate wealth is to purchase an costly home. Your upkeep and property taxes will shoot up. So will your home funds when you take out a mortgage. However no less than you will get to get pleasure from your wealth, in contrast to with shares.

As a private finance fanatic, you’ll most definitely get richer than the common individual since you’re saving and investing greater than the common individual. Given the ability of consistency and compounding, there is a good likelihood {that a} majority of us will die with some huge cash left over.

In consequence, one answer is to search for candy new homes. If in case you have children, the greatest time to personal the nicest home you’ll be able to afford is when you will have essentially the most variety of heartbeats at residence.

A larger deal with decumulation

The funding positive factors of 2020 and 2021 have been sudden. In consequence, I’ve collected an “overage” of wealth primarily based on my pro-forma web value calculations by age.

Given I dedicated to decumulation beginning at age 45 in 2022, I must proactively spend extra money to get again to my baseline monetary projections upon demise. The 2022 bear market helped. Nevertheless, the 2023 bull market has “harm.”

I may purchase a brand new automobile however I’ve dedicated to driving my automobile for no less than 10 years till December 2026. Spending extra money on meals was an attention-grabbing experiment for 3 months. However there’s solely a lot we will eat. I used to be sick of most finer meals after three months.

As well as, given I am captivated with sending my children to group school, I’ll have extra financial savings in the event that they go given we super-funded two 529 plans. Due to this fact, all that is actually left is shopping for a midlife disaster home.

4) The will to really feel protected

After the pandemic, lots of our expectations about security and independence have been shattered. In consequence, it was pure for individuals to wish to acquire extra management of their lives by shopping for greater properties. Given we’re Kings and Queens of our properties, the bigger the house, the extra management we regain.

On the excessive, if we purchase a house with land as massive as the town we stay in, our life would revert again to regular. We may basically do something we would like since we owned every thing.

Once we lose management, we naturally wish to take again management by way of possession. A midlife disaster residence offers us larger management and safety from unknown risks.

Larger home for rising children

After realizing my residence transform would take means longer than anticipated in 2020, I made a decision to purchase an already accomplished, absolutely reworked residence. Humorous sufficient, our new house is about the identical dimension as our now-remodeled outdated residence. However I wasn’t prepared to stay in a building zone for an additional 2+ years with a child and toddler.

Life is just about again to pre-pandemic regular. However the sense of eager to really feel protected, particularly with children, has not gone away. In consequence, I am searching for properties in even safer neighborhoods with decrease ranges of site visitors. A hidden neighborhood within the hills could be superb!

Having a gated entrance yard supplies me psychological aid from the children operating onto the road and getting run over. Dwelling on a hill reduces the variety of crimes. It feels good to really feel protected. In truth, feeling protected may be priceless.

Wanting Nothing Is Additionally Good Factor

Because the not too long ago deceased Sinead O’Connor as soon as mentioned, “I don’t need what I have not bought.”

It is great to be content material with all that now we have. On the similar time, it additionally feels wasteful to hoard wealth past what we’d like. That is the conundrum many FIRE fans face.

Minimalism and early retirement go hand in hand. However when you do cash too properly, you’ll find yourself with an excessive amount of of it. How ironic. And what a darn disgrace.

As an alternative of shopping for a midlife disaster home, possibly it might be higher to make a journey of a lifetime as an alternative. Or possibly getting a pet will assist resolve the loneliness inside.

There are many cheaper methods to resolve shallowness points, together with going to remedy each week. Heck, when you’re dissatisfied with life you may even give you the option to earn more money by discovering a brand new job or return to work when you’re retired.

Personally, I extremely worth dwelling in a pleasant residence. I spend a lot time at residence writing, podcasting, and caring for my household, that spending cash on a house looks like nice worth. And the truth that a house may additionally probably go up in worth makes it a great asset.

You may suppose you are going by way of a midlife disaster by shopping for a nicer residence you do not want. Nevertheless, when you’re in tune together with your feelings, you may be appearing completely rational in spite of everything.

Reader Questions And Ideas

Do you suppose there’s such factor as a midlife disaster home? Why can we purchase nicer properties we do not want? Have you ever or anyone you already know purchased a midlife disaster home earlier than? In that case, how did that work out?

Should you’re trying to put money into actual property passively, try Fundrise. Fundrise manages over $3.3 billion from over 400,000 traders. It predominantly invests in residential and industrial properties within the Sunbelt, the place valuations are decrease and yields are increased.

Hear and subscribe to The Monetary Samurai podcast on Apple or Spotify. I interview specialists of their respective fields and focus on a few of the most attention-grabbing matters on this website. Please share, fee, and overview!

Be part of 60,000+ others and join the free Monetary Samurai e-newsletter. Monetary Samurai is among the largest independently-owned private finance websites that began in 2009.